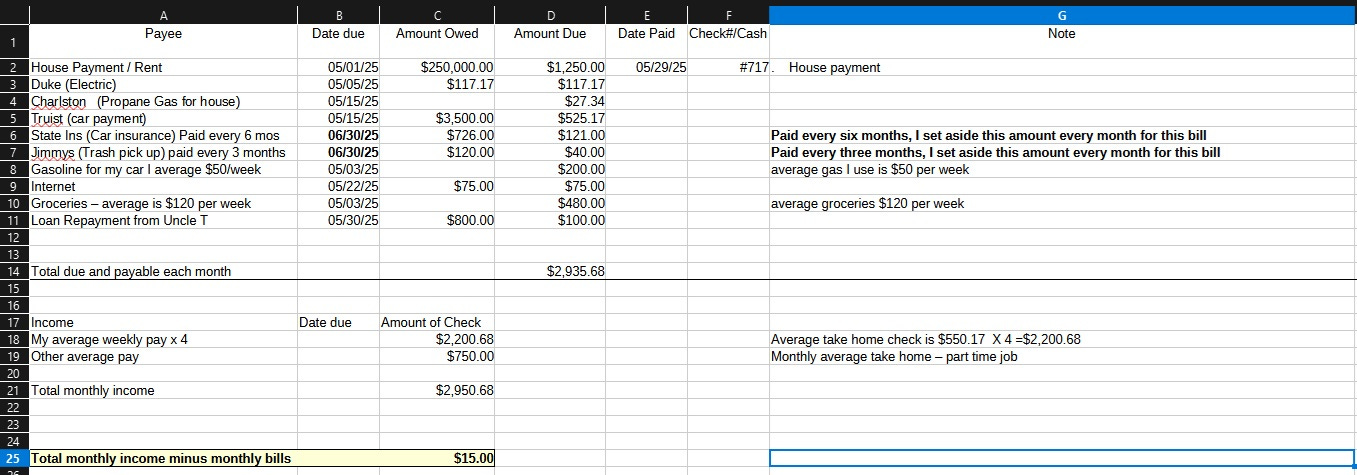

We’ve had to Climb out of tens of thousands of dollars in debt before. It was a slog because we only had one income at that time. We did it by sticking to a strict budget for almost two years. Here is an example of a strict budget:

You will notice that there is none of the following in that budget:

Netflix

Cable

Gym memberships

ANY memberships

Dining out

Fast food

Clothing

Absolutely zero disposable income

Some of what we did for free entertainment:

Library – books, movies and music

Walking

Bonfires

Teaching myself to draw

Writing letters to my granddaughter (with doodles)

Learned to dance from You Tube

Learned to make sourdough from You Tube

Learned a bunch of crap from You Tube and Rumble

Began a Substack

Kept my professional learning going

Began taking free online Hillsdale College courses https://online.hillsdale.edu/

Anything outside of the bare necessities listed were not paid for. Everything that needed cash had to wait a few months until I had some disposable cash. Emergencies are rare during those times, but they end up in personal loans from friends/family and get paid back before everything else.

Those numbers and accounts are made up in the above graphic, however, we had less than $50 a month after debts were paid. As soon as the personal loan was paid back, we had a little breathing room. That was 2015. By Spring of 2021 we had great credit, and enough money saved up to buy a house on our own without financial help from anybody.

Fast forward a few months to the end of 2021 where I lost my job in December (end of the Trump effect from first term). I work in the tech vertical and had bought a house on a tiny farm in agricultural area. Nothing around us. It’s heaven. However, I was unprepared for the reality that 2022-2024 would bring to the tech world. A mountain of horrible DEI/H1B/discriminatory practices became common. Being a conservative, American, Christian, unvaxxed, white person in tech means you are UNEMPLOYED and unemployable. No local jobs to be had.

I lost my job, but didn’t panic (silly me) as I was at the top of my game, had many certifications and boatloads of experience and great references (all of which meant nothing in a meritless job competition). Our credit is beyond shit as I didn’t realize that I was now unemployable and falsely thought I was going to get a job any day now for a couple of years.

Our heating and cooling system died within days of my job loss. We spent most of our cash savings getting that replacement started (but not finished). We had bought the house in March and I lost my job in December, April through December we were spending most of our money on fixing up the house and property. By mid 2022 I was still hopeful and certain I would get a job, but we had to borrow money to eat at that point. Our cards were maxed and credit was shot.

Once again we are dug in a debt hole. We will get out. This economy will fire up and I will get a job and we will stick to our budget and climb out with record speed. I know it. We live in the Appalachian foothills, so living without heat and air conditioning is doable if you are healthy, and we are blessed with great health. So heat and air conditioning can wait until our debt is paid off.

So when I get my job we will have a budget similar to the one above, with no frills or fluff. It wont take much to get us living comfortably again, I only need to make half of what I was making before since we now know how to live on almost nothing. So climbing out will be a snap. I don’t care about my lousy credit, most of Americans have lousy credit right now, more Americans are in the same boat as me than you would think.

That is how powerful it is to know where you stand (knowing your financial situation) and knowing how to get yourself where you want to be financially. This all begins with a basic budget, self control, realistic goals and grows from there. A basic budget is where you start. Basic stuff.

Link to free MS Office knockoff - LibreOffice

https://www.libreoffice.org/

KC

Very inspiring!

Been using LibreOffice for a good long time.

It's spreadsheet app, Calc, has been all I've needed for years.